Sample- MM Business Blue Print Document for Chemicals/ Polymers for New Consultants

Sample:- MM Business Blue Print Document for Chemicals/ Polymers for New Consultants

Business Blue print Document preparation is the second phase in SAP ASAP METHODOLOGY. it is requires complete understanding of client business Process after details study of their Process and also the Outcome of AS-IS/ TO-BE steps. it is very crucial step in every project Phase and it is requires high skill efficiency, Clear listening and understanding of the Process and good planning on further phases. I hope expertised consultants will agree this and if failure or mis-out in blue print will also have an impact in next consecutive phases in Project and finally we cannot achieve success.even i can say failure in Blue Printing will made many projects failure. so requesting careful study of the process and details given in this blog. I have given here Business process, Master Data, Assumption, Gaps, ABAP Developments- Forms & Reports. This is again framed for New Consultants in SAP and experts already known to it. this blog is just a sample to uderstand the Blue Print Document Preparation.

1.Introduction

1.1 Objective of this report

The report initially gives an overview of the Materials management Module purview along with CIN and Warehouse Management. This would essentially help in defining the boundaries of the module and also in identifying the activities to be performed within Materials management Module in SAP. Subsequently, the report discusses in detail, the proposed coverage of SAP at ZZZ, in terms of organisational entities and business processes. Each business process has been described with all the variations. The authorisation requirements would be identified and configured during the configuration phase.

1.2 Organization Overview

ZZZ Group SAP implementation spans the following two group companies:

- ZZZ Chemicals Limited

- ZZZ Polymers Limited

1.2.1 About ZZZ Chemicals

ZZZ Chemicals Ltd. is in the business of manufacturing and marketing of petroleum products

It serves the following market segments:

- The industrial market consisting of industrial users of oils who buy the products in bulk on regular basis. These include private sector as well as public sector companies.

- The retail market consisting of small users of oils to whom products are sold through multiple levels of demand chain (C&F Agents, Dealers and Retailers).

- Export market

The product categories of ZZZ are:

Specialty oils, with a focus on Industrial customers, consisting of:

- Transformer oils

- Light Liquid Paraffin

- Heavy Liquid Paraffin

- White Oils

- Speciality Oils

- Lube Oils with a focus on retail users

- ZZZ has about 350 stock keeping units, consisting of Product, Grade, Brand and Pack size.ZZZ’s business units are:

- Head office in BANGALORE

- Two factories – HYDERABAD & CALCUTTA

- One packing unit at BANGALORE

- Five branch offices

- About 40 C&F Agents spread all over India.

1.2.2 About ZZZ Polymers

ZZZ Polymers Ltd. is situated in Coimbatore and in engaged in the business of manufacturing and selling petroleum products and polymers catering to the requirement of telecom industry, pharmaceutical & cosmetic industry as well as manufacturing emulsifiable waxes & emulsions for textile industry. Presently about 80% of the turnover is for Export products viz.: CFC, Transformer Oils, White Oil and Petroleum Jelly. The domestic market demand involves emulsifiable wax BW 3xx and small quantities of CFC, Petroleum Jelly and Optical Fibre Jelly. SPL employs about 75 people.

1.3 Materials Management at zzz

The Material Management Module has multiple processes broadly divided into Procurement, Good Receipt and Inventory Management across businesses in ZZZ Group.

Purchasing is a component of Materials Management (MM). The Materials Management (MM) module is fully integrated with the other modules of the SAP System. It supports all the phases of materials management: materials planning and control, purchasing, goods receiving, inventory management, and invoice verification

The purchasing module deals with the:

- External procurement of materials and services

- Determination of possible sources of supply for a requirement identified by the materials planning and control system or arising directly within a user department

- Purchasing communicates with other modules in the SAP System to ensure a constant flow of information. For example, it works side by side with the following modules like Controlling (CO), Financial Accounting (FI), Sales and Distribution (SD), Quality Control (QM).

Inventory Management component of Material management deals with the following tasks:

- Management of material stocks on a quantity and value basis

- Planning, Entry, and Documentation of all Goods Movements

- Carrying out the Physical Inventory.

Logistics Invoice Verification is a part of Materials Management (MM). It is situated at the end of the logistics supply chain that includes Purchasing, Inventory Management, and Invoice Verification. It is in Logistics Invoice Verification that incoming invoices are verified in terms of their content, prices, and arithmetic. When the invoice is posted, the invoice data is saved in the system. The system updates the data saved in the invoice documents in Materials Management and Financial Accounting.

The Materials Management (MM) module will cover the following business processes:

Organization Structure (Related to Materials)

Consumption Based MRP – Planning of material either based on Reorder Point or Forecast based.

Purchase Requisition Processing – Generation of Requisitions for materials and services based on MRP, Real time (manual), sales order and projects.

RFQ/Quotation Processing – Generation of Request for Quotation (RFQ), Quotation processing and comparison.

Purchase Order Processing – Creating Purchase Orders (PO) for materials and services with respect to PR, Quotation, Contracts, direct PO, Stock Transfer Order, Sub-Contracting, Releasing the PO to vendors.

Vendor Evaluation – Vendor Evaluation based on Quality and reliability parameters.

Inventory Management – Managing material receipt, Issues and transfers in the plants, and Physical Inventory.

Inventory Valuation – Material Valuation based on moving average price and standard price based on inventory transactions.

Invoice Verification – Bill passing for the vendors for materials and services, Credit Note.

2. Organizational elements in ZZZ (MM)

Normally we have org structure Diagram in Blue Print. Here i have not used the Diagram

2.1.1 Plants

The Plant is an operating area within a company where there is stock movement. Each of the manufacturing locations and A & B locations shall be identified as a Plant in SAP. For the purposes of valuation of inventory at ZZZ Group, the Plant is defined as the Valuation Level within SAP where materials will be valued.

The plant is embedded in the organizational structure as follows:

The Plant is assigned to a single Company code. A Company code can have several plants. As ZZZ has two companies i.e. ZZZ Chemical and ZZZ Polymer each companies will have their own set of Plants.

Several Storage Locations in which material stocks are managed can belong to a plant. A plant can have one or more storage locations.

A Plant can be assigned to several combinations of Sales Organisation and Distribution Channel.

A Plant can have several Shipping Points. A Shipping Point can be assigned to several Plants A plant has an Address, Language, and Country.

A plant has its own material master data. You can maintain data at plant level for the following views on a material master record in particular: MRP, Purchasing, Storage, Work scheduling, Production resources/tools, Forecasting, Quality management, Sales, Accounting and Costing.

The plant plays an important role in Material Valuation, Inventory Management, MRP, Production, and Costing & Plant Maintenance.

The list of plants attached to ZZZ Chemicals Limited as under:

ZZZ Chemicals

Trichy Plant – 1100

Chennai Plant – 1200

Salem Plant – 1300

Outside Storage – 1400

Delhi Branch – 1500

8 Windmills – 1701 – 1708

43 A & B Locations – 1601 – 1643

Head Office – 1800

The list of plants attached to ZZZ Polymers Company is as under:

ZZZ

mohali Plant – 2100

SSSS Plant – 2200

Head Office – 2300

Outside Location – 2400

Dependencies

One additional logical plant of Head office has to be created as the procurement activities for ZZZ chemical and ZZZ polymer is handled centrally from head office.

SSSS Plant 2200 attached to company ZZZ will be used only for managing initial assets and inventory. Transactions for this plant will not be mapped.

The procurement of administrative and Service items at head office will have to be identified as per the companies.

All the material stored in the outside locations will have to be identified as per the company code and will be accounted in one Plant for each company code i.e. Outside Locations

For identification of stock at various Storage Locations and tanks within the storage locations will done through ware house management.

As materials are stored at A&B and each A&B has its own valuation, the same will be created as Plants.

2.1.2 Purchase Organizations

A Purchase Organization is an organizational unit within logistics in SAP R/3, which subdivides an enterprise to facilitate efficient and effective Purchasing. A Purchase Organization procures materials and services, negotiates conditions of purchase with vendors, and bears responsibility for such transactions.

A Purchasing Organization can be divided into several purchasing groups that are responsible for different operational areas. Each purchasing organization has its own –

- Vendor Master Data

- Purchase Info Records

- Conditions for Pricing

Purchasing Organisation for ZZZ Group: ZZZ group will have one Central Purchase Organisation which will be responsible for procurement for ZZZ Chemical and ZZZ Polymers.

ZZZ Group will also have plant wise Decentralised Purchase Organisation to cater miscellaneous procurement handled independently by each plant.

T001 – Central Purchase Org (handled by Head office)

C001 – Decentralised P org for Trichy

C002 – Decentralised P org for Chennai

C003 – Decentralised P org for Salem

C003 – Central P org for ZZZ

P001 – Decentralised P org for Coimbatore

These purchasing organisations will cater to all the procurement activities required for the plants.

For example all the plant specific raw materials/spares/tools etc. will be bought by the plant procurement department using the respective purchasing organisation.

2.1.3 Purchasing Groups

The purchasing organisation is further subdivided into purchasing groups (buyer groups), which are responsible for day-to-day buying activities. A purchasing group is an entity, which communicates with the vendor.

The purchasing group is internally responsible for the procurement of a material or an external service and as a rule the principal channel for a company’s dealings with its vendors.

Purchasing groups for ZZZ Group

H01 – Imports – Presently the person Responsible are Mr xxxxl and yyyyy

H02 – RM Domestic, Packing and Transport – Presently the person responsible Mr cccc

H03 – Engineering & capital & consumables purchase – Presently the person responsible Mr ffffff

H04 – For administrative purchases

P01 – Trichy Plant – Presently the person responsible is Plant Head Trichy

P02 – Salem Plant – Presently the person responsible is Plant Head Salem

P03 – Mangalore Plant – Presently the person responsible is Plant Head Mangalore

P03 – Madras Plant – Presently the person responsible is Plant Head Madras.

2.1.4 Storage Locations

A storage location is the place where stock is physically kept within a plant.

A storage location has the following attributes:

- There shall one or more storage locations within a plant.

- A storage location has its code and description.

- It is possible to store material data specific to a storage location.

- Stocks are managed only on a quantity basis and not on a value basis at storage location level.

- Physical inventories are carried out at storage location level.

- Storage location are always created for a plant.

Storage Locations for ZZZ Group are

Plant Trichy 1100

| S007 | OIL-1 Tank Area |

| S008 | Near Weigh BRIDGE. |

| S009 | PM Speciality Open |

| S010 | Scrap |

| S011 | Rejected Speciality |

| S012 | Rejected Lubes. |

| S013 | Engineering Stores |

| S014 | R & D |

| S015 | TO Godown. |

| S016 | Lube Plant |

| S017 | Lube open |

| S018 | New warehouse I |

| S019 | New warehouse 2 |

Plant: Chennai 1200

| S101 | Scrap |

| S102 | Rejected |

| S103 | Engineering Stores |

| S104 | Trading Stores |

| S105 | FG/PM Stores |

| S106 | Returnable Stores. |

Plant: Salem 1300

| S204 | Unit No. 1 | ||

| S205 | Unit No. 2 | ||

| S206 | Rear end road | ||

| S207 | New BSR -Road | ||

| S208 | Area OPP .to Unit I & II | ||

| S209 | Unit NO.2 | ||

| S210 | Unit NO. 1 | ||

| S211 | Engg. Stores | ||

| S212 | Utility Block | ||

| S213 | Scrap | ||

Dependencies

Each plant will have minimum one storage location to monitor inventory related transaction

For ZZZ company

- Delhi Plant, A & B Plants, Wind Mill Plants and HO will have one Storage location each

For ZZZ company

- Salem Plant and HO will have one storage location.

2.1.5 Warehouse

The Warehouse Management (WM) application provides flexible, automated support to assist you in processing all goods movements and in maintaining current stock inventories in your warehousing complex.

WM supports warehousing processes by making it possible for you to

- Define and manage complex warehousing structures

- Optimize material flow using advanced put away and picking techniques

- Process goods receipts, goods issues and stock transfers quickly and easily

For ZZZ Group Ware house structure is as follows:

Assumptions

- In ZZZ Group Ware House Management will activated only for Tanks in the respective plants.

- All the tanks will be created as BIN.

3 Material Master

The material master contains information on all the materials that a company procures or produces, stores, and sells. It is the company’s central source for retrieving material-specific data. This information is stored in individual material master records.

Material master is integrated with

- Material Management

- Production Planning

- Sales and Distribution

- Accounting and Controlling

Creation of material code is always with reference to the material type for which it is created Material number generation is at the Level of Material Type.

- Each material type will be identified with a different number range series.

- Uniform material codification has to be maintained across all the plants of ZZZ

- Material code has to be maintained on which CENVAT is allowed as per CIN requirement.

3.1.1 The material types identified for ZZZ

- Raw Materials

- Stores and Spares

- Packing Material

- Semi-Finished goods (Intermediate Goods)

- Finished goods

- Scrap

- Trading goods

- Engineering for capital goods

- Administration

3.1.2 Assumptions

- ZZZ will follow the external numbering for material codification system.

- The numbering will be restricted to maximum 6 characters

- Material Code will unique across all plants

- Raw material e.g. Base oil will be batch managed

- Raw Material, Stores and Spares, Packing Material and Trading Goods will have Moving Average Price (MAP)

- Semi Finished, Finished and Scraps goods will have Standard Price (SP)

- If the same material is sourced from local and foreign vendors, it will have a separate code and valuations

- Bonded and Ex-bonded material will have a unique code and hence one valuation

- Each material type will have a valuation class and a G/L A/c linked to it for inventory postings.

3.1.3 Unit of Measurement

Following Units of measurement can be maintained in material master.

- Base Unit of Measurement

- Sales Unit of measurement

- Ordering Unit of measurement

- Issue Unit of measurement

For any entry of UOM other than base unit of measurement, a conversion factor with respect to the base UOM will have to be maintained. At The material transactions the appropriate conversion will be carried out. For e.g. base UOM is KG however Issue UOM is L & the Conversion rate is 1kg=2L then if 100kg of material is issued the stock will be reduced by 200L.The stock overview report can be seen in both UOM’s.

SAP standard reports provide the information in the Base Unit of Measurement.

The relation between base unit of measure and alternative unit of measure has to be identified properly and relationship will be unique for the material. The material cannot have multiple values for an alternative unit of measure with respect to the base unit of measure.

For ZZZ

Base oils the base unit of measurement will be Litres.

The base UOM will be unique for a material for all the plants.

3.2 Vendor Master

Vendor shall be created for the Purchasing Organisation and company code wherein it’s going to be used. The various Account groups, which shall be used to create a vendor, are:

- Domestic Vendors

- Import Vendors

- Service Vendors

- Employees

- FI vendors

- For advanced licence tracking

3.2.1 Assumptions

- Vendor numbering will be alpha-numeric linked to Account Groups and the number ranges will be externally generated with separate no. range assigned to various account groups

- If a vendor is supplying from multiple location, separate vendor codes shall be created for each of the vendor location.

- Dummy Vendors will be created for each of the Advance License. A separate reconciliation account will be identified for these type of vendors created per advance license

- The vendors are maintained at company code and purchasing organisation level and cannot be identified by plant level.

3.3 Batch Management

Certain raw materials in stores be batch managed. For these materials, batch numbering shall be externally assigned. Material having similar characteristics but slight difference in specifications shall be managed with activation of batch management.

Batch will be at plant level, while transferring the material from one plant to another; same batch number shall be identified at the receiving plant.

Batches will be identified manually during issue. There will be no batch for SFG. All FG’s except lubes will be batch managed.

The batches Number will be captured at the time of GRN preparation which will be entered manually. Batch number can be maintained as vendor wise, make wise, date wise etc. as per requirement.

ZZZ will use vessel wise batch numbers for imports raw material.

3.4 Excise Masters

Following India-specific (from statutory standpoint) masters need to be created in SAP

- Chapter ID Descriptions

- Material Chapter ID combination

- Material Assessable values

- Modvat determination

- Vendor Excise details

- Customer Excise details

- Excise rates

- Exceptional Excise rates

- Additional Excise rates

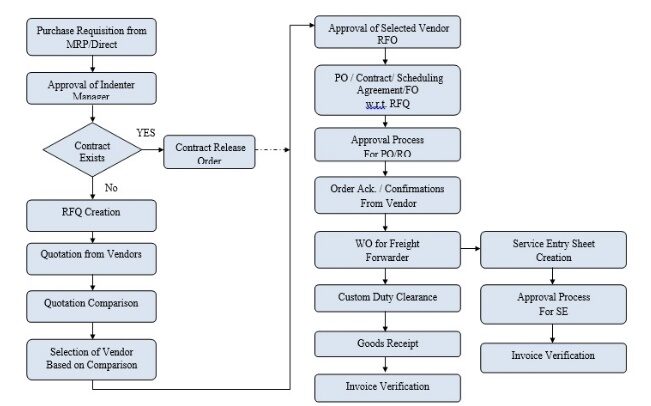

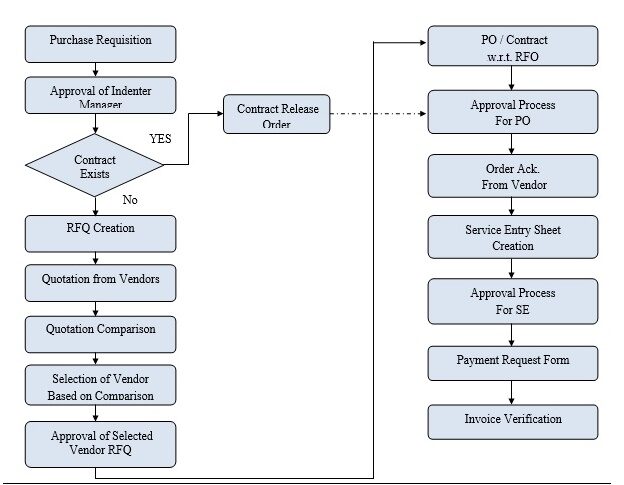

4.Procurement

In SAP the procurement process can be broadly defined as per the eight steps defined below. In ZZZ the Material requirement planning (MRP) of raw material will be derived based on Bill of Material of finished goods. The forecast for the finished goods will be indicated in the Sales and operation planning (SOP). The requirement of the raw material will be net of the available stock, open purchase order and open purchase requisition.

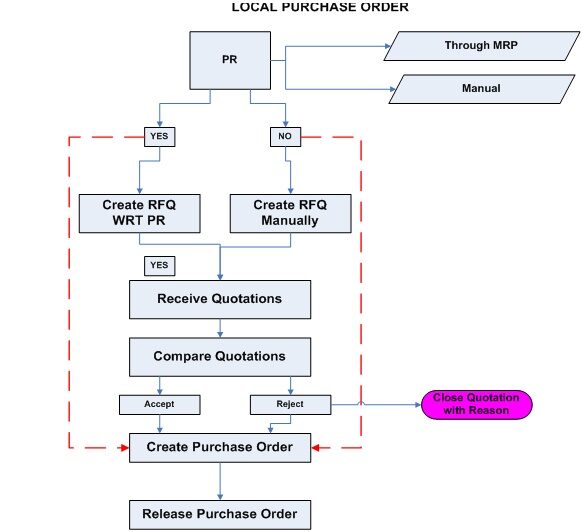

4.1 Purchase Requisition

A Purchase Requisition is an internal document, which is a request or instruction to Purchasing Department to procure a certain quantity of a material or services so that it is available at a certain point in time.

The following shall be the source of Purchase Requisition (PR):

- MRP (Materials requirement planning including reorder /forecast)

- Manual

- Maintenance Order

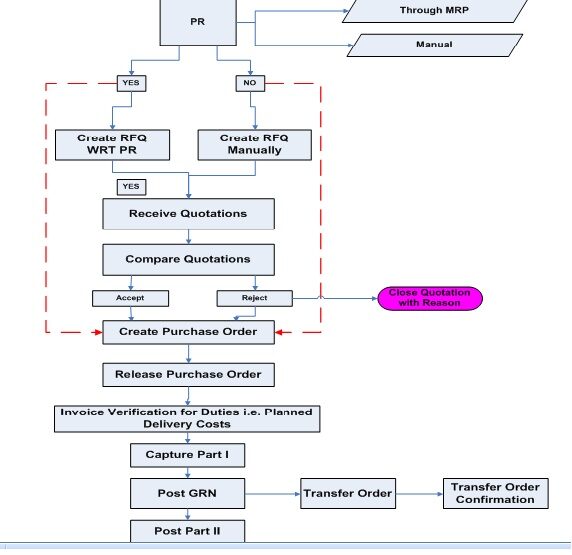

PR to RFQ/ PO

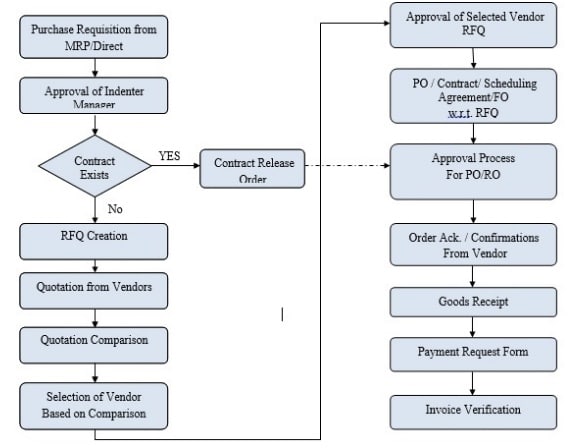

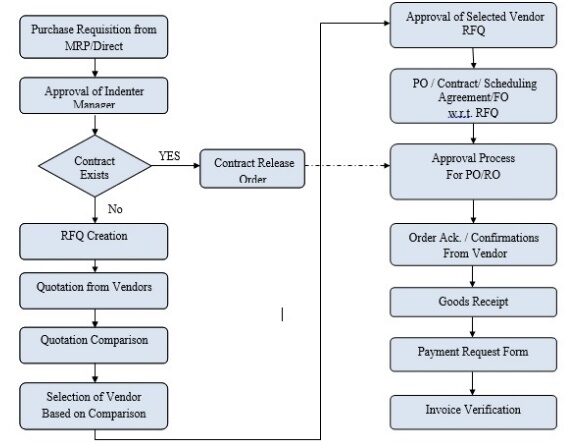

4.1.1 Process Flow

From MRP:

For Raw materials, Packing materials and Stores and Spares the Purchase Requisition will be automatically created through MRP run. Raw material and Packing material requirement will be based on the BOM of FG and SFG. In case of Stores and Spares the material requirement will be based on reorder point, which will be defined in the Material Masters.

The user can also create a Manual Requisition for specific requirement and will be created by authorised personnel.

From Maintenance Order:

System will automatically generate the PR for the non stock able items in the order.

Document types for Purchase Requisitions NB- Purchase requisitions.

RFQ to Purchase Order

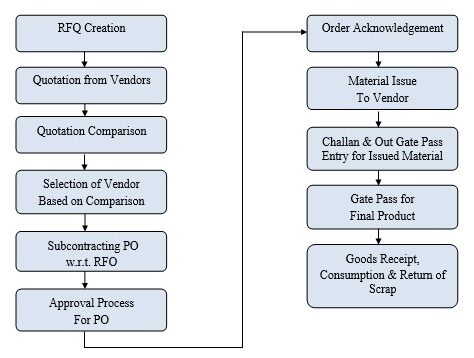

4.2 Process Flow

Request for Quotations are the enquiries issued to the identified vendors for receiving the Price quote of required materials.

RFQ’s will be issued to each of the approved vendors for a particular material. Based on the numbers of vendors the same number of RFQ’s will be issued i.e. A unique RFQ will be issued to each of the approved vendors for a particular material.

RFQ will be created with reference to the Purchase requisition if it exists as per the PR procedure earlier defined e.g. PR created manually or through MRP. RFQ’s also will be created without any reference if no PR exists.

Each individual RFQ created will have Header and Item Information.

- Header Information will capture vendor details based on the Vendor Master and General Information in the form Text.

- Item Information will capture the details of the material, the quantity required and delivery dates.

In the RFQ the user will identify the following details

- Purchasing Organisation

- Purchase Group

- Deadline for Submission of quotation

- Material and Quantity

- Plant for which the material is required.

All the RFQ issued to different vendors for the procurement of the same material will be identified with a same and unique collective number. The collective number will be identified by the user as it will form a base for comparison of quotation from different vendors for the same material

A tracking number also can be identified by the user for each of the RFQ’s for the his operating convenience

There shall be RFQ document type: AN

4.3 Vendor Quotation and Bid evaluation

4.3.1 Process Flow

Quotations will be received from the vendors based on the RFQ sent to them. The Quotations will have the various pricing conditions quoted by the vendor for the material specified in RFQ.

The quotation received will be entered in the system with reference to RFQ issued. The RFQ and quotation will be identified with the same number.

The detail price break up will be identified in the quotation. For e.g. some of the details are stated below.

- Basic Rate

- Discount

- Packing and Forwarding

- Excise Duty

- VAT

- Freight (Inward and Outward)

Assumptions

The above price break-up will be the form pricing condition in the Price Schema which will be attached in the Vendor master.

Quotation compare

The quotation compare will be based on the collective number identified in the RFQ. All the RFQ identified with a unique collective number will be compared. The system will calculate the net effective price after taking into consideration the secondary elements in the price i.e. Discount, Freight, packing etc.

The system will consider the taxation during calculate the effective / net price. I.e. The net price will be net of excise, but the sales tax will not be taken into account.

All quotation comparisons will be on the net landed price. If the user wants to refer the detail pricing of each quotation, then on the same screen the user will have to click on the quotation and the data will be furnished.

All the quotations also can be compared with reference to ideal quotation which will have a best price.

The system will rank the compared quotation based on the landed price.

Based on the RFQ generated in the SAP, the vendor sends his quotation this is captured in the RFQ made for the vendor in the SAP.

The details of the quote, i.e. the conditions (like Basic price, freight, discounts etc) are keyed into the system. Quotations received from the various suppliers shall be entered into the system with reference to RFQ generated in the system. Quotation comparison can be carried out using various Quotation numbers or using the Collective number.

- In SAP the RFQ & Quotations shall have the same number.

- The quotation shall be compared based on the pricing conditions entered in the system.

4.3.2 Gaps / Issues Identified and Solutions

The system does not compare the quotations based on payment terms, Inco terms and technical aspects of the material.

4.3.3 Forms and reports required

Report on Quotation Compare will have to be developed.

4.4 Purchase order Stock items

A purchase order is a formal request to a vendor to supply certain goods or services under certain conditions.

4.4.1 Process Flow

A purchase order is a formal request to a vendor to supply certain goods or services under certain conditions.

The user will create Purchase Order can be created with reference to the RFQ or Last Purchase Order, this will help the system to copy all the details in the RFQ on to the purchase order and the relation of the RFQ and the purchase order is set in the system

If purchase order is created with reference the vendor details e.g. Vendor Address, Payment Terms, Inco terms will be copied from the vendor master.

Purchase Order can also be created with out any reference, in this case the user will have to enter all the details e.g. Vendor, material, pricing condition etc

Purchase Order will be made by ZZZ Group for those material for which the price is negotiated for each transaction are subject to change for ever new transaction e.g. Base Oils , Additives etc.

For a particular transaction if the Payment Terms and Inco term are different from the vendor master, the same can be changed in the Purchase order.

The pricing related conditions will be copied from the RFQ and also can be independently maintained in the Purchase Orders. The pricing conditions shall be assigned a value either in percentage terms, value terms or per quantity basis.

The different conditions (primary and secondary price elements) get defaulted in the Quotations or purchase order based on the pricing schema attached to the schema group field of vendor master. New pricing conditions can also be added and existing condition shall be changed only before first goods receipt entry posted against PO.

Material and Vendor related Excise and Sales tax details shall be identified using the Tax Code at the Item level in PO. The tax codes will have to be entered in the PO at the item level and contain the following information:

- Excise Duty

- Additional Excise duty

- Special Excise duty

- Sales Tax applicable / VAT related condition

- Surcharges over tax as applicable for a specific region

- Turnover tax

The excise duty shall be populated in the PO based on the Excise masters maintained for the material code in the CIN version of SAP to be entered in the PO at an item level. Excise rate master and material excise detail has to be maintained for proper excise duty calculation and CENVAT claim.

The user shall specify the Plant, Purchasing organisation, Purchasing group, Material code, quantity of the material in the purchase order.

Over delivery tolerances will be maintained in the purchase order as per the requirements for e.g. imported material where excess receipts are expected to certain extent. In case if there is an excess stock receipt beyond the over delivery tolerance identified in PO, receipts can be made only after changing the quantities in PO.

Header text and Item text shall be maintained to communicate the vendor regarding specific terms and conditions which are specific to the purchase

ZZZ will have the following document types for a purchase order.

- Import Purchase Order

- Domestic Purchase Order – this will cover Subcontracting also

- Engineering, IT, Laboratory – Non Stock Purchases and Services

- Stock Transfer Order

- Asset PO

- Service PO

The number ranges will be different for each of the above document types and company code this will help the user identify the Purchase order at a glance.

The system will create a purchase order number which will be system generated and the series of the number will based on the document type and Company Code which is specified during creation of the purchase order.

The PO will be amended for quantity as per the receiving plant on the receipt of the material before the GRN

Condition types for CVD, Cess on CVD, Basic customs duty, Cess on customs duty and ADC will be percentage based and in foreign currency for which the invoice verification for delivery costs will be made in INR.

All the condition types will be copied to the new PO from the old PO along with the percentage or value or quantity based rate.

The unwanted condition types will be deleted from the new PO.

All the secondary cost conditions will be identified in the PO with some vendor as no condition can be added nor the value can be changed once a GRN is prepared.

Contracts will be prepared on the secondary vendors for transportation, barging, CHA, insurance, etc and will be only used as reference; no data will be copied from the contract in the PO by the system.

The secondary vendors will be changed at the time of GRN if different than that identified in the PO.

Importing against Advance License: If the import receipts are against an Advance License where no Custom Duty and CVD has to be paid, the amount liable against the Custom and CVD conditions will to be identified against a Dummy Vendor in the PO. This vendor number will be same as AL number, which will be same as the Advance License Number. For creation of these liabilities, all the duties and taxes will be identified in the PO (like any normal import PO). This vendor will be credited with the duty liability and which will be subsequently settled against an income clearing account.

On the sales side, a report will be generated to track exports obligations to help Finance create the necessary entries.

4.4.2 Exceptions and Variations

Retrospective Amendments are not available in SAP. The changes made to PO will not affect the GRN which is posted before the changes. The changes shall be affected only to the subsequent document posted after the changes.

4.4.3 Forms and reports required

Purchase Order Print layout will be developed

4.4.4 Conditions in Purchase Order

Condition types are the various cost carrier components in P.O that determine the value with which the Material is valuated & how the reimbursement for the same is being carried out. Conditions for import and local procurement will be different.

ZZZ will have the following condition

- Basic Price

- Discount

- Surcharge

- Freight

- Cess i.e. Market Cess for NMMC

- Survey Charges

- Insurance

- Barging

- Clearing and Forwarding

- Wharfage

- Pricing procedure is a summation of the condition type in a set sequence which helps the system calculate the net priceThere will two pricing procedure for ZZZ i.e. Local and Imports.

4.4.5 Delivery Costs in Purchase Orders

The secondary vendor for freight, Insurance and clearing will be identified in the Purchase order against the specific condition type. The secondary vendor can be changed during the good receipt stage also.

The delivery condition charges shall be booked to a separate account code at the time of Goods receipt. It is necessary to identify the Freight, Clearing, Insurance vendor in the PO for the proper valuation of the material at the GRN stage. However at the time of preparation of GRN, the actual vendor to whom the payment is to be made can also be identified. In case if the transportation charges have to be paid to the material vendor than in delivery condition the vendor field can be left blank & the freight gets automatically allocated to the Material Vendor

- Freight Supplier can be changed at the GRN stage only if the planned delivery conditions have been identified in PO. However the value of the delivery cost can be changed vat the time of bill passing only.

- Delivery Charges cannot be changed /amended in GRN

- Any changes in the value of delivery charges (e.g. freight, Clearing, Insurance) can be carried out at the time of invoice verification. Thus vendor can be paid based on the actual invoice amount.

4.4.6 Excise and Sales tax related Details

User shall identify relevant tax codes in PO based on which the Excise Duty and Sales Tax shall be calculated.

- The user needs to select correct tax code in the PO

- The user needs to select correct document type (order type) in the PO.

- The tax code shall be identified at item level in the PO

- TDS shall be calculated in the Financial Accounting system. Please refer to the Business Blueprint of Financial Accounting for details regarding TDS.

- Excise and Sales Tax (VAT) will posted to a different account and will not be posted to the stock account.

4.4.7 Account Assigned PO (Consumption Orders)

Account Assigned PO will be used in case of materials which are non-coded e.g. Engineering, Stationery, Laboratory items, Administration and other consumable where the stock tracking for such material is not required and a cost centre can be directly debited for its consumption.

Specific requirement of any department can be booked using the account assigned PO and identifying a cost centre linked to the department in the PO.

- At the time of Goods receipt for such materials, stock of the material will not be updated and directly the total cost of the procured material shall be debited to an identified account assignment i.e. cost centre Mechanical, Civil, Electrical or internal order.

4.4.8 Asset Purchase

All the asset purchases shall be linked to the asset class. Such PO shall be account assigned to an Asset. Finance department shall provide the required details to the purchase department regarding the Asset class and Asset number, which need to be identified in the asset PO.

All asset purchases shall be account assigned PO with account assignment as ‘Asset’. Before raising Asset PO, FI will provide the Asset number.

4.4.9 Release Procedure for Purchase Order

Release procedures will be defined for the following documents:

- Purchase Requisition

- Purchase Orders

In case of Purchase Requisitions only Engineering Purchase Requisitions will follow a release procedure as the engineering specification are to be vetted out.

In case of Purchase Order the entire PO will follow a Release Procedure. Release procedure will be different for each of the Purchasing Groups as per the person responsible (i.e. Imports, Local, Service, Admin and Plant Purchases). The entire POs will be finally released by the MD. All types of PO will have a release procedure including STO.

4.4.10 Forms and reports required

Purchase Order Print layout will be developed

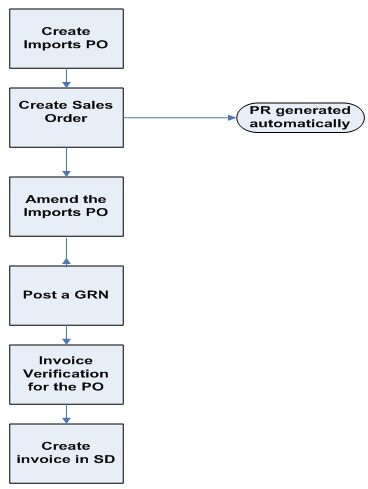

4.5 High Sea Sales

ZZZ will use the High Sea Sales scenario for the sale of base oil. The process flow will be as shown below.

4.5.1 Exceptions and Variations

The PO has to be amended as the sales order will be prepared after the PO. The existing line item has to be deleted / modified and new line item will be added with reference to the PR generated from the Sales Order.

A statistical GRN will be made in the system causing the following accounting entries:

Dr. Cost of Goods Sold

Cr. GR/IR Account

This entry will eliminate the need for taking the material into stock, making customer delivery and posting goods issue.

Customer invoice can be raised once the statistical GRN and the invoice verification are posted.

5.Inventory Management

5.1 Material Receipt

- A goods receipt is a goods movement with which the receipt of goods from a vendor or from production is posted. A goods receipt leads to increase of material stock.

- Material shall be received at the plants or the delivery address other than the plant identified in the PO.

- In case of Subcontracting PO, the finished goods shall be received at the plants from where raw material was issued for processing.

5.1.1 Goods Receipt Procedure

- In Goods receipt is done using Movement Type 101, Stock is directly posted to unrestricted stock or quality inspection stock and vendor can be paid after invoice verification.

- Both rejection and acceptance cannot be done for the material on which quality management is not activated. The system can not allow posting accepted quantity and rejected quantity simultaneously in single posting and for such condition two step goods receipt procedure is to be followed.

Irrespective of the procedure followed,

- No material shall be received without any reference of the PO

- ZZZ can use single step goods for material like spares, regular consumable items etc.

- Any changes to the PO shall be reflected before preparation of GR

- There shall be only one internal number range for the all types of Goods Receipt across all the plants.

Goods Receipt for Local Material

- Scenario IA: Good receipt of Excisable Material

- CENVAT related details should be captured by the user before preparing the GR. User shall enter the Vendors Excise Invoice details in the SAP CIN module. The reference of the internally generated document shall be given at the time of GR. At the time of GR, RG23A Part I shall be gets updated if excise invoice has been captured before GRN.

- Part II entries will be generated at the time of Excise Invoice Verify and post.

- In case if Excise Invoice is captured after GR, Part I and Part II entries will be updated at the time of Excise Invoice Verify and Post.

- If Excise Invoice has not accompanied the material, the material can be received into unrestricted stock. Whenever Excise invoice comes, Excise Invoice is captured after GR, Part I and Part II entries will be updated at the time of Excise Invoice Verify and Post. Invoice verification can be entered only after the excise invoice verified & posted.

- If Vendor has not given the excise invoice for excisable material, then user has to change the PO as non excisable before posting of goods receipt and vendor invoice.

- Scenario IA: Good receipt of Non Excisable Material

- If the material is not excisable then user shall prepare the GRN using movement 101 without use of CIN Excise Module.

The following accounting entry will be passed in the Financial Accounts

Dr. RM/PM Stock Account

Cr. GR/IR Account

Cr. Freight Clearing Account

Excise Entry for revenue purchases

Dr. Cenvat BED/ AED/ SED Account

Cr. Cenvat Clearing Account

Excise Entry for Capital purchases

Dr. Cenvat BED/ AED/ SED Account

Dr. Cenvat on hold Account

Cr. Cenvat Clearing Account

Goods Receipt for Import Material

Import good receipts will be carried out either at the outside storage location or directly at the Manufacturing Plant

Amendments will have to done in the PO, for quantity splitting as per receiving plant and any other condition if required

The break up of the pricing elements (i.e. freight, Barging, CVD etc) will be copied from the last PO

If the material is received at Outside Storage location, Stock transfer Order will be used to transfer the material to the manufacturing plant.

- Scenario IIA: Goods Receipt for imports at Outside Storage Locations

- Preparation of PO

- Release of PO

- The invoice verification shall be carried out for CVD before the goods receipt of the material in the system.

- Posting of invoice verification for duty charges as delivery costs

- The excise invoice (i.e. CVD) shall be captured and posted in CIN.

- The GRN shall be prepared with respect to PO.

- Posting of part 2 in dummy excise registration

- Preparing of Transfer order & confirmation for warehouse

- Placing in Bin

- Scenario IIB: Goods Receipt for imports directly at Manufacturing Plant

- Preparation of PO

- Release of PO

- The invoice verification shall be carried out for CVD before the goods receipt of the material in the system.

- Posting of invoice verification for duty charges as delivery costs

- The excise invoice (i.e. CVD) shall be captured and posted in CIN.

- The GRN shall be prepared with respect to PO.

- Posting of part 2 in respective plants excise registration

- Preparing of Transfer order & confirmation for warehouse

- Placing in Bin.

Accounting Entry:

Invoice Verification for Custom Duty when material not purchased against Advance License

Dr. Cenvat Clearing Account

Dr. Custom Clearing Account

Cr. Vendor Account

Invoice Verification for Custom Duty when material purchased against Advance License.

Dr. Custom Clearing Account

Cr. License Vendor Account (Recon A/c-adv license receivable A/c)

Goods receipt when the material is not purchased against advance License

Dr. Stock Account

Cr. GR/ IR Account

Cr. Custom Clearing Account

Goods receipt when the material is purchased against advance License

Dr. Stock Account

Cr. GR/ IR Account

Cr. Custom Clearing Account

Capture Excise Part II when the material is not purchased against advance License

Dr. BED Account

Dr. Cess Account

Cr. Cenvat Clearing Account

Invoice Verification for Foreign Vendor

On receipt of vendor bill the following entry will be passed:

Dr. GR/IR Account

Cr. Vendor Account

- Scenario IIC: Goods Receipt for imports in Manufacturing Plant from Outside Storage Locations (Stock Transport Order)

- Creation of Stock transport order with supplying plant as Outside Storage Location and receiving Plant as Manufacturing Plant

- Creation of Replenishment Delivery

- Preparing of Transfer order and Confirmation for warehouse

- Creation of Post Good issue to reduce the inventory at Outside Storage Location

- Pro-forma Invoice

- Excise Invoice at Supplying Plant (i.e. Outside Storage Locations)

- Good receipt at Receiving Plant (i.e. Manufacturing Plant)

- Preparing of Transfer order and Confirmation for warehouse

- Excise Invoice post and capture in receiving plant.

Other Good Receipts

- Scenario III: Goods Receipt for Assets Material / Spares

- The cycle of local /import GRN holds good for capital materials.

- The type of material (Asset) shall be specified while capturing the excise invoice.

- The GRN shall be prepared with respect to excise invoice. The system shall update RG23C Part I after the GRN has been posted.

- The excise invoice shall be posted and the system shall pass an entry for claiming 50% Modvat for the current year updating RG23C Part II. In the subsequent year remaining 50% Modvat shall be claimed.

- Scenario IV: Goods Receipt for Consumable materials

- The regular GRN cycle holds well for the consumable materials with the exception that system shall not update the stock of the material.

- It shall be assumed that the material is consumed after good receipt no separate goods issue transaction needs to be carried out.

Accounting entries in FI at the time of GRN

Dr. Consumption A/c

Cr. GR/IR Clearing A/c

- Scenario V: Goods Receipt for Production Order

- Goods shall be received in the concerned plant and storage location with respect to production order. This shall result into converting of stocks from work in progress to semi finished material or finished good. This shall result into increase of stocks in the storage location.

Accounting entries in FI at the time of GRN

Dr. FG inventory A/c

Cr. Factory output A/c / Cost of production A/c

- Scenario VI: Goods Receipt against Returnable Gate Pass

- Service PO will be created for the repairs to be made along with the charges

- The inventory of the asset eg pump or motor will be generated against a non valuated material code

- A transfer posting to the subcontractor stock will be entered in SAP to keep a track of the stock

- The material will be sent out of the gate against a printed copy of Returnable gate pass from SAP.

- On receipt of the repaired asset the transfer posting made earlier will be reversed

- Service entry sheet will be posted for the repair charges and the invoice verification will be done for the same. The GRN for the services will be posted automatically in the background.

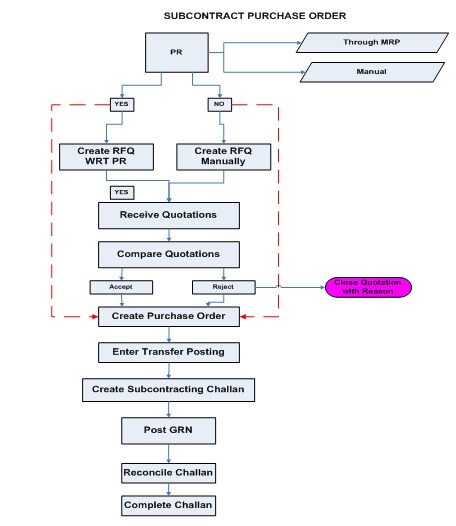

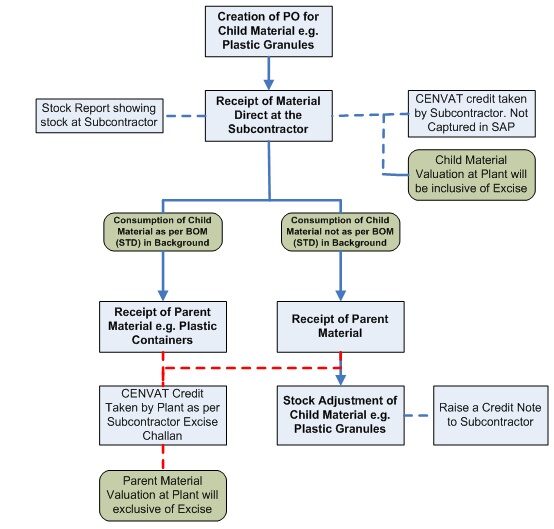

- Scenario VII: Goods Receipt for Subcontracting Purchase Order and Material received in Plant and transferred to Subcontractor

- Scenario VIII: Goods Receipt for Subcontracting Purchase Order material is directly received at Subcontractor.

- The PO shall be prepared on the subcontractor for the End Product (incoming material)

- The components (outgoing material) required for the manufacture of the end product shall be specified in the PO manually or based on the Bill of Material and will be supplied by ZZZ.

The components shall be issued to the vendor with respect to the subcontracting PO through transfer posting. This will result in the posting and identification of stocks at the vendor location. The raw materials can also be received directly at the subcontractor by

- posting a GRN for the PO in which the subcontractor has been identified in the delivery address of the PO.

- No Accounting transactions shall take place when stocks (components) are transferred to the vendor location.

- A 57F4 document (Excise Challan) shall be generated and printed (optional) based on the transfer-posting document in CIN.

- On the receipt of the End Product from the vendor (subcontractor) at plant, the GRN shall the prepared with respect to the subcontracting PO and 57F4 document.

- This shall result in the posting of the consumption entries for the components lying at the vendor location.

- The 57F4 document shall be reconciled & completed in CIN after final receipt of the End Product.

- Logistics Invoice Verification shall be carried out for the labour charges for the end product supplied by the Vendor.

- The subcontracting PO shall have the Labour charges as the price component.

5.1.2 Excise details to be captured at goods receipt from vendor

- User would capture excise-related details at the time of preparing the GR. User will enter the Vendor’s Excise Invoice details in the GRN transaction. At the time of GR, RG23 A or C Part I will get updated.

- Part II entries will be generated at the time of Excise Invoice Verify and Post stage which will be done after GR

- In case if Excise Invoice is captured after GR, Part I and Part II entries will be updated at the time of Excise Invoice Verify and Post.

- If Excise Invoice has not accompanied the material, the material can be received into GR Blocked stock. The GR block stock shall not update the total valuated stock and will not be available for usage. Whenever Excise invoice comes, the material can be taken to unrestricted stock from GR block stock. However, from unrestricted stock the material cannot be moved back to GR block stock.

- If Excise Invoice has not accompanied the material and material is required for use in production the user can post the goods receipt and subsequently post the CENVAT with the reference of PO and goods receipt material document number.

5.1.3 Gaps / Issues Identified and Solutions

As per standard SAP only two weights can be captured in the GRN out of which one is actual GRN quantity the other one can be either BOE/ BL quantity or actual quantity received at the dock. Development will be done to capture four different weights.

Transport vendor and the barge vendor will be changed at the time of GRN if different than that identified in the PO.

5.1.4 Forms and reports required

- Report for outturn i.e. the weights captured at the different stages will be developed

- Returnable Gate Pass

- Non Returnable Gate Pass

5.1.5 Interfaces

Weigh Bridge Interface will be developed to meet the business requirement of identifying the quantity in weight and volume of the raw materials (e.g. Oils) which are received in Tankers.

5.2 Material Issues (Consumption)

A goods issue (GI) is a good movement with which a material withdrawal or material issue, a material consumption or a shipment of good to a customer is posted. A good Issue leads to reduction of the stocks. Material shall be issued to various departments. The issues can be specific against a production order, maintenance order or generally to a cost centre against a reservation. The consumption entries shall get posted at the time of goods issue. Other than high value maintenance spares, all materials will be charged to consumption as soon as it issued from the main stores. In certain cases the material is issued to production or cost centre but is not identified as consumption. For e.g. materials issued to shop floor locations, for such cases, a separate storage location will be identified in the system for tracking the stock on the shop floor.

High value maintenance spares such as chemical & fluxes shall be transferred from Main Stores storage location to the Shop floor location. Hence, the issues for production/ cost centre from the main storage will be shown as transfer posting from storage location to storage. No accounting entries shall be generated for the transfer posting. On charging the materials to a work order or cost centre, issue to production order/cost centre will be recorded. Thus exact consumption quantity will be recorded for the production order. For other products, which can be issued, as per exact requirement, a material issue to production order will be carried out from the main storage location directly.

- Negative stocks shall not be allowed in the system.

- The materials such as chemicals, oils, engineering goods shall be stored in the defined stores and directly issued to the production order or cost centre if required.

- The materials such as high value maintenance spares shall be stored in the engineering stores and transferred to the shop location and subsequently the issue shall be booked against maintenance order or cost centre if required.

- If stores want to issue material other than originally planned in the reservation then material has to be changed in the reservation with the required alternative material.

- There shall be only one internal number range for all types of Goods Issue and Transfer Posting documents across all the plants.

- When the material is issued against the production order the following accounting entries will take place in FI

Dr. RM stock A/c

Cr. Inventory Change A/c

5.2.1 Transfer Postings

- During the normal business activity it may be essential to move the material physical from one place to the other within the same company code, or within the same plant or move it from one stock type to another or from one material to another. These can be done in SAP by transfer posting.

The major material transfers that can be carried out in SAP are

- Plant to Plant

- Storage Location to Storage Location

- Stock to Stock i.e. unrestricted to blocked

- Batch to Batch

- Bin to Bin

- Material to Material.

5.2.2 Plant to plant transfers

- If the material is transferred from one plant to another of the same company code Stock transport orders “STO” will be used wherein the transfers are carried out using the Sales functionality of Delivery.

- Transportation cost will be included in the PO and cost of transportation will be loaded onto the stock valuation of the material at the receiving location.

- STO will be used to transfer the material from Trichy / Chennai to the A&B agents. In the STO the MAP (Moving Average Price) will defaulted as the Basic price and the transport cost will be identified as one of the price

- If material is moving from one plant to another plant. The excise invoice needs to be prepared in CIN for the transfer of the excisable material. Excise will be debited at originating plant and same amount shall get credited at the receiving plant by capturing excise invoice details of the issuing plant.

5.2.3 Transfer of material from Manufacturing Plant to Stocking Plant or A&B (with Excise invoice)

- The transfer shall be carried out using Stock Transport Order (STO) with outbound delivery for finished goods. STO shall be created in the MM module by the supplying plant for the receiving plant. Based on the STO, delivery shall be carried out in Sales and Distribution (SD) module of SAP. The excise invoice will also be prepared at the time of good delivery. The material shall be received in the receiving plant using movement type 101 in Materials Management. Till such time goods shall be tracked as ‘stock-in-transit’.

- Stocking Plant or A&B can maintain the finished goods stock in batches, which are received from manufacturing plant.

- Stocking Plant or A&B can only avail the CENVAT mentioned in the excise invoice received from manufacturing plant.

5.2.4 Material Transfer from Storage Location to Storage Location

- The material can be transfer from one location to another within the plant. This transaction does not involve accounting entry for the material.

- ZZZ can use this transaction to transfer the material form material inspection storage location to stores. Similarly the materials like spares that are issued to the specific departments can be transferred from stores to the specific departments and subsequently the consumption can be booked for the material if required.

5.2.5 Material to Material Transfer

- If a material changes over time in such a way that it no longer corresponds to the features defined in the material master record, but to the features of a different material, the user can carry out transfer posting from material to material.

- A transfer posting from material to material results in the transferred quantity being managed under a different material number. A material master record must exist for the receiving material.

- Parallel to the material document, an accounting document is posted. The issuing material master record determines the value of the transfer posting.

- The material to material transfer should be done in consultation with accounts as it involves accounting entries being posted for the material.

- Both the materials should have the same base unit of measure.

5.2.6 Stock to stock

When the quality inspection posting is completed the material transfers from Quality stock to Unrestricted use stock. Similarly it is also possible to move ‘unrestricted use’ stock to a specific sales order stock or specific project stock.

5.2.7 Bin to Bin transfer

As with all stock movements, to transfer stock from one storage bin to another storage bin within a warehouse number you first create a transfer order.

To transfer stock of a material from one storage type to another, you can display the bin stock of the source storage type (same as with the bin status report). From this display you can select the stock to be transferred and create the respective transfer orders.

ZZZ will use the bin to bin transfer posting for transferring the material from bonded to ex bonded location.

The